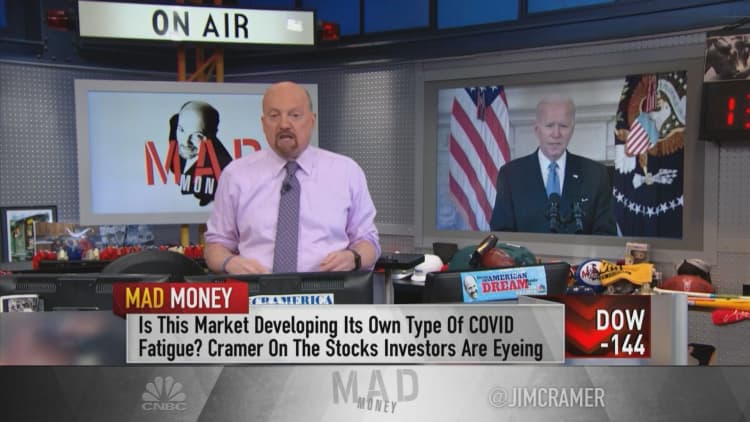

The stock market is riding on reopening optimism, causing tech stocks to fall and cyclical stocks to rise in Tuesday's session, CNBC's Jim Cramer said.

While the major averages were all down at the close, Cramer said the action was defined by a decline in consistent operators and a rise in sporadic boom-and-bust stocks.

"It's all about optimism, people. Investors are voting with their feet," the "Mad Money" host said. "They're leaving these secular growth stories, the stocks of companies that do well regardless of whether the economy is running hot or cold. Instead, they're finding their way to stocks of companies that only make big money when business is booming."

The comments come after the overall market retreated from gains made on Monday, which followed a tough sell-off last week. The Dow Jones Industrial Average on Tuesday slid 144 points to 31,391.52 for a 0.46% drop. The S&P 500 pulled back 0.81% to 3,870.29. The tech-heavy Nasdaq Composite fell 1.7% to 13,358.79.

S&P sector indexes also traded lower during the session, with the exception of materials. Tech and consumer discretionary parts of the market had the toughest showing, with both indexes joining the Nasdaq in declining more than 1%.

Cramer said the market activity reflects investors betting on the odds that citizens can soon drop their Covid-19 protective masks and states can soon drop coronavirus restrictions and return the economy to normal, thanks to the country's progress on the vaccine front. Still, a tug of war remains between those who are optimistic and those who are cautious, he added.

Texas and Mississippi governors earlier Tuesday announced plans to remove mask-wearing mandates and all restrictions on business activity within their states.

"They're betting we'll soon be able to rip our masks off and go back to normal, and that's the crux of this market right now," Cramer said. "For the moment, the people who think our long national nightmares coming to an end. They are the ones who are winning."

He warned, however, that the moment in the market is still vulnerable to risks. Cramer said the country could reopen too quickly and that variants of the virus, such as the strain first discovered in South Africa, could lead to another spike if the country lets its guard down.

While President Joe Biden expects to sign a $1.9 trillion stimulus spending package that's making its way through Congress later this month, any hiccup in pushing the bill through the Senate could have an impact on the market.

"There's still a lot that could go wrong," Cramer said.

Questions for Cramer?

Call Cramer: 1-800-743-CNBC

Want to take a deep dive into Cramer's world? Hit him up!

Mad Money Twitter - Jim Cramer Twitter - Facebook - Instagram

Questions, comments, suggestions for the "Mad Money" website? madcap@cnbc.com